Companies Are Buying Carbon Credit Exchanges

Carbon credit exchanges have become extremely popular for entities looking to reduce their carbon footprint. A carbon credit equals one ton of CO2 equivalent and allows polluters to offset their emissions by purchasing credits from companies that reduce greenhouse gases in the atmosphere (like reforestation projects). The global market is expected to grow rapidly as governments and businesses around the world increasingly realize the value in combating climate change.

A company looking to purchase carbon credit exchange must be careful to avoid low-quality ones that don’t represent real emissions reductions. To do this, they can use the services of a carbon broker that can offer a variety of carbon offset projects to choose from. These brokers often maintain accounts on carbon offset program registries and can directly retire a buyer’s carbon credits through them. They can also help to evaluate the quality of each project.

However, there are many brokers who only sell the credits that they have developed themselves and may not be able to provide as much impartial information about each project. This makes it even more important for companies to do their own due diligence on each project before they buy.

Which Companies Are Buying Carbon Credit Exchanges?

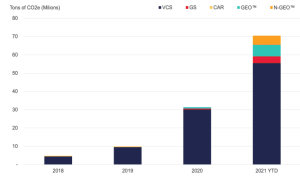

There are two major markets for carbon credits: the regulated market, set by cap-and-trade regulations at the national and state levels, and the voluntary market. Companies that operate under a cap-and-trade program are allotted a certain number of credits each year that they can emit. Those that emit more than their allotment must purchase credits from the regulatory market to stay under their caps. Alternatively, they can also use the voluntary market to offset their emissions.

The regulated market is more complex than the voluntary market. It requires a lot of paperwork and reporting as well as verification from the projects that generate the carbon credits to make sure that they are true emission reductions. The complexities of the regulated market and the requirements to verify carbon credits can be challenging for small- and medium-sized buyers, who may prefer to work with a smaller broker that can give them the personal service they need.

Some of the more well-known carbon credit exchanges include the Climate Action Reserve, Xpansiv, and AirCarbon Exchange. The latter, founded in 2019, is based in Singapore and provides a digital platform where airlines can purchase carbon credits through third-party developers of reforestation and land management projects. It claims to host more than 90% of all voluntary carbon credit transactions worldwide.

In 2021, the consumer goods conglomerate Unilever joined with Disney, Google, Microsoft, and Salesforce to form the Business Alliance for Scaling Climate Solutions. This partnership will focus on improving carbon markets and ensuring that “emissions reductions or removals claimed by companies are additional, real, quantifiable, verifiable, and permanent.”

While the majority of Unilever’s carbon offset purchases are linked to forestry projects, it has made an effort to diversify its portfolio in recent years. For example, the company has purchased credits from the Clean Cookstoves project that teaches women in developing countries how to build clay cookstoves that are safe and energy efficient. The company has also purchased credits from renewable energy infrastructure projects that develop alternative power sources to fossil fuels.